Does a Power of Attorney End at Death?

A power of attorney is a powerful planning document that enables you (the “principal”) to give another person (the “agent” or “attorney-in-fact”) the power to act for you while you are alive.

Because it is often prepared in the context of estate planning, many believe it gives their agents the power to continue acting after their death.

Although every state’s laws and forms vary, most power of attorney forms specify that the agency relationship created by a power of attorney ends upon a person’s death.

What Does a Power of Attorney Do?

A power of attorney (POA) can convey a significant range of power to the person you appoint. This includes the ability to do the following on your behalf:

- Enter into real estate transactions;

- Enter into leases and purchase personal property;

- Buy bonds or other securities;

- Engage in banking transactions;

- Engage in business operating transactions;

- Handle insurance transactions;

- Engage in estate transactions;

- Make decisions concerning any claims you have or in which you may be involved;

- Make gifts or charitable donations;

- Manage any benefits you receive or are entitled to;

- Manage the financial aspects of your health care;

- Manage your retirement accounts;

- Handle your tax matters;

- Delegate any of the above responsibilities to a third party

Power of Attorney Forms

Most POA forms allow you to choose how specific or broad you would like the powers you give to be so that you can tailor a power of attorney to suit your needs. An agent can also update a power of attorney over time as a principal’s needs change.

In many states, these powers, once delegated, remain in place even in the event of your incapacity. People frequently execute a power of attorney for this reason. They do not want to worry about what may happen should they become incapacitated or whether a loved one will have the ability to handle their affairs if they are no longer able to do so.

Does a Power of Attorney End at Death?

That being said, a power of attorney does end at death. So, if you have entrusted a particular person with carrying out certain functions on your behalf while you were alive, those abilities cease when you pass away.

If you wish for the same person to continue handling your affairs after you die, you would need to specify they serve as the executor or personal representative of your will or trustee of your trust.

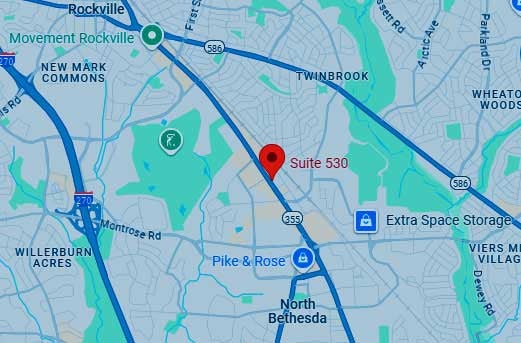

If you are concerned about maintaining continuity or making sure a particular person oversees your affairs upon your passing, be sure speak with an estate planning attorney at Elville and Associates. Every person’s situation and needs. Knowing where to start to create a customized estate plan – which includes powers of attorney documents – can be intimidating, but help is available and there is nothing to fear. Consider a free consultation with the experienced estate planning attorneys at Elville and Associates to get the process started. Consultations are the most ideal and best way to get your specific questions answered, have your attorney fully understand your situation, and help create solutions and a path forward for you. Contact us today to get started.

In the wake of the pandemic, rising inflation, mass shooting tragedies, and other events, more people recognize that they need to plan for the future. Yet while financial planning has been at the top of many Americans’ minds, a vast majority of people have stalled in creating an estate plan.

According to a new study completed by Caring.com, a mere one in three people has an estate plan in place. Worse yet, more than 40 percent of those without a will report that they wouldn’t create an estate plan until they had encountered a serious health concern.

Why Is It Important to Make an Estate Plan Sooner Rather Than Later?

It is simply dangerous to wait until you have a health issue before you create an estate plan. Without one, you could potentially lose control over your money, property, health care, and, in some circumstances, the guardianship of your children. In addition, your loved ones may not receive the assets, property, or sentimentally valuable items you would have wanted to pass down to them after your death.

Depending on what health condition or acute injury may unexpectedly befall you, you may be unable to speak, understand others, or advocate for yourself. Part of the purpose of advance planning documents, such as a health care directive, is to maintain your bodily autonomy and express your wishes when you cannot.

Bottom line: The reason to create an estate plan is to put protections in place not only for you, but also for your loved ones.

Barriers to Advance Planning

Despite understanding the need for estate planning, with 64 percent of people saying they believe it is important, most have not made it a priority. In the 2023 study, Americans reported procrastinating to create an estate plan for the following reasons:

- 35 percent do not believe they have enough money or assets to leave behind

- 14 percent said that inflation’s negative effect on their assets has made estate or financial planning less of a priority for them

- 15 percent reported that they did not know enough about estate planning, so they felt too intimidated to start

- 42 percent stated they want to begin estate planning, but simply have not gotten around to it

When Should You Create an Estate Plan?

Every American adult should create an estate plan, and it is virtually never too early to go about setting one up.

In fact, once a child turns 18 and legally becomes an adult, they are entitled to make their own decisions regarding their medical care, finances, and education. In gaining legal authority over those parts of their lives, they should consider setting up an estate plan.

For high school graduates, the months prior to moving away to college can be an ideal time to look into getting these kinds of documents in order. At first glance, this may seem overboard to some; however, nothing could be further from the truth. Keep in mind the wide diversity of family structures.

For example, perhaps a young person would want their property to go to a younger sibling, rather than a stepparent. Similarly, an individual might want the grandparent who raised them, not a parent, to assume decisions over their medical care in the event of an accident.

In the Caring.com survey, 69 percent of the study respondents said they believe that people should create an estate plan before they reach age 55. Despite that, less than half of Americans 55 and older have at least one estate planning document.

Many Americans Will Wait to Make an Estate Plan Until It’s Too Late

Many Americans are at risk of waiting until their health is compromised to seek estate planning advice or draft any documents. According to the study’s findings:

- 41 percent of respondents said they would not worry about creating a will unless they received a medical diagnosis or had a health scare

- 21 percent would wait until retirement age

- 22 percent said they would not create an estate plan unless they bought a home

- 20 percent want to wait until they are married or have children

- 14 percent would create an estate plan if their employer offered the benefit

Although each of the above reasons may seem valid, it is important to be prepared before any of these life events occur. Otherwise, it may be too late to act and create an estate plan.

What Are Some of the Key Estate Planning Documents?

Among the most important documents you may consider securing include:

- a will, through which you can specify who will receive your property and who will become guardians of your minor children after your death

- an advance directive, in which you name a person who will carry out your wishes regarding your medical care if you are incapacitated

- a power of attorney, which gives you the ability to name someone you trust to act on your behalf in certain situations if you are unable to do so

Additional Resources

Knowing where to start to create an estate plan can be intimidating, but help is available and there is nothing to fear. Consider a free consultation with the experienced estate planning attorneys at Elville and Associates to get the process started. Consultations are the most ideal and best way to get your specific questions answered, have your attorney fully understand your situation, and help create solutions and a path forward for you. Contact us today to get started.

#elvilleeducation

[et_pb_section fb_built=”1″ admin_label=”section” _builder_version=”4.21.0″ custom_padding=”0px||0px||true|false” global_colors_info=”{}”][et_pb_row admin_label=”row” _builder_version=”4.21.0″ background_size=”initial” background_position=”top_left” background_repeat=”repeat” custom_padding=”0px||0px||true|false” global_colors_info=”{}”][et_pb_column type=”4_4″ _builder_version=”4.16″ custom_padding=”|||” global_colors_info=”{}” custom_padding__hover=”|||”][et_pb_video src=”https://www.youtube.com/watch?v=rLF8tu65PvI” _builder_version=”4.21.0″ _module_preset=”default” global_colors_info=”{}”][/et_pb_video][et_pb_text _builder_version=”4.21.0″ _module_preset=”default” global_colors_info=”{}”]

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

[et_pb_section fb_built=”1″ admin_label=”section” _builder_version=”4.21.0″ custom_padding=”0px||0px||true|false” global_colors_info=”{}”][et_pb_row admin_label=”row” _builder_version=”4.21.0″ background_size=”initial” background_position=”top_left” background_repeat=”repeat” custom_padding=”0px||0px||true|false” global_colors_info=”{}”][et_pb_column type=”4_4″ _builder_version=”4.16″ custom_padding=”|||” global_colors_info=”{}” custom_padding__hover=”|||”][et_pb_video src=”https://www.youtube.com/watch?v=AqNAA7z92_Y” _builder_version=”4.21.0″ _module_preset=”default” global_colors_info=”{}”][/et_pb_video][et_pb_text _builder_version=”4.21.0″ _module_preset=”default” global_colors_info=”{}”]

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

[et_pb_section fb_built=”1″ admin_label=”section” _builder_version=”4.21.0″ custom_padding=”0px||0px||true|false” global_colors_info=”{}”][et_pb_row admin_label=”row” _builder_version=”4.21.0″ background_size=”initial” background_position=”top_left” background_repeat=”repeat” custom_padding=”0px||0px||true|false” global_colors_info=”{}”][et_pb_column type=”4_4″ _builder_version=”4.16″ custom_padding=”|||” global_colors_info=”{}” custom_padding__hover=”|||”][et_pb_video src=”https://www.youtube.com/watch?v=N8kYXYkfHgE” _builder_version=”4.21.0″ _module_preset=”default” global_colors_info=”{}”][/et_pb_video][et_pb_text _builder_version=”4.21.0″ _module_preset=”default” global_colors_info=”{}”]

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

Webinar — Supported Decision Making for Loved Ones With Disabilities – Breaking Through 2.0

[et_pb_section fb_built=”1″ admin_label=”section” _builder_version=”4.21.0″ custom_padding=”0px||0px||true|false” global_colors_info=”{}”][et_pb_row admin_label=”row” _builder_version=”4.21.0″ background_size=”initial” background_position=”top_left” background_repeat=”repeat” custom_padding=”0px||0px||true|false” global_colors_info=”{}”][et_pb_column type=”4_4″ _builder_version=”4.16″ custom_padding=”|||” global_colors_info=”{}” custom_padding__hover=”|||”][et_pb_video src=”https://www.youtube.com/watch?v=UoXk5CSybx8&t=33s” _builder_version=”4.21.0″ _module_preset=”default” global_colors_info=”{}”][/et_pb_video][et_pb_text _builder_version=”4.21.0″ _module_preset=”default” global_colors_info=”{}”]

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

March Is Developmental Disabilities Awareness Month – and Supported Decision Making Is Taking Off in Maryland

By: Stephen R. Elville, J.D., LL.M. – Managing Principal and Lead Attorney – Elville and Associates, P.C.

Do you know someone with developmental disabilities? If not, you probably know someone who does. And even if that’s not the case during this Developmental Disabilities Awareness Month, you most likely will somewhere along your life’s path. Why do I ask? Because whether you already know someone with disabilities or not, it is important to remember that they have rights just like you and me, and have always had such rights, it’s just that those rights and the ability to exercise capacity and self-determine were not always recognized legally (and clearly). By way of the new Supported Decision Making law, Maryland now recognizes the rights of individuals with disabilities to direct their own lives and exercise capacity and self-determination. This includes persons young or old with disabilities. For an in-depth discussion of this issue please see my article from June 2022 by visiting here.

But in summary, what is Supported Decision Making in Maryland? In my view, Supported Decision Making (SDM) is the ability of a person with disabilities to make their own decisions to whatever extent possible, provided that they have the support to do so (mainly with the support of their supporting decision maker). As you become familiar with this new Maryland law, notice that the person with disabilities is the person who retains their right to make their own decisions and does not yield this right to anyone else. Again, we might say “I can make my own decisions to whatever extent possible, providing that I have the support to do so.” SDM challenges (and changes) old notions and paradigms of incapacity and capacity. Further, as you gain an understanding of Supported Decision Making in Maryland you may ask “Where does the new SDM law begin and where does it end?” – the law is so broad in scope. Well, it’s no secret that some persons with disabilities will understand their new rights of self-determination, while others will not. It is also true that parents and other loved ones of a person with disabilities may embrace the possibilities of Supported Decision Making, while others will not, or remain skeptical.

But regardless of our current understanding of Supported Decision Making in Maryland and its application, what’s important to remember during this Developmental Disabilities Awareness Month is that like a new jet airliner flying to its destination, this new Supported Decision Making law has just lifted off the runway and is climbing to altitude for its long-term journey. Our job is to learn what Supported Decision Making in Maryland really is, including its broad application, and to go along for the ride as persons with disabilities (and those with intellectual disabilities) are now recognized and empowered like never before under the law.

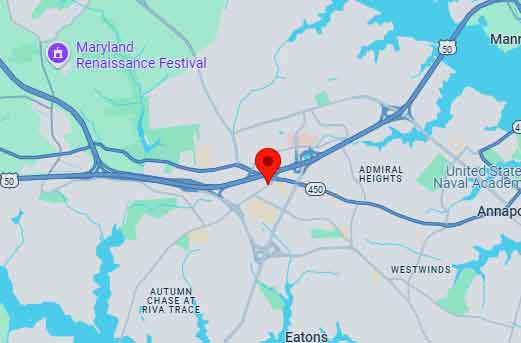

Elville and Associates’ Managing Principal and Lead Attorney Stephen Elville’s work is centered in special needs planning, elder law, and estate planning with special emphasis in the areas of tax planning and asset protection. As a member of the Academy of Special Needs Planners, the National Academy of Elder Law Attorneys, and the National Network of Estate Planning Attorneys, he works to bring peace of mind to clients by creating solutions to their needs through counseling and education using the very best legal-technical knowledge available. He is a seasoned speaker and each year presents at dozens of webinars, workshops, conferences, and continuing education events. Steve has also been named to the Maryland Super Lawyers list eight times, including the past seven consecutive years. Steve is also the founder

and president of the firm’s charitable organization, the Elville Center for the Creative Arts, in 2014, a 501(c)(3) organization that partners with school music programs and other organizations such as the Annapolis Symphony Orchestra to give the gift of music to children who want to participate in music but don’t have the means to do so on their own. Steve may be reached at steve@elvilleassociates.com, or by phone at 443-343-8708 x108.

Presented by Elville and Associates’ Managing Principal and Lead Attorney Stephen R. Elville, webinar attendees will come to understand what is involved in the planning process for a special needs family and the importance of preserving your loved one’s financial security and quality of life.

The key issues of understanding the role of public benefits, making decisions about the future, Maryland ABLE, and using estate planning and trusts to protect assets will be discussed along with the types of special needs trusts and their specific purposes (along with who the decision makers and beneficiaries can be in these trusts). Also, to be touched upon will be the “planning team concept” – how your planning team (attorney, financial advisor, CPA) – can work together to help provide your family peace of mind during the special needs planning process.

More Webinars from Elville and Associates

The education of clients and their families through counseling and superior legal-technical knowledge is the mission of Elville and Associates. We hold multiple educational events every month. Click to view our calendar of educational webinars and events or visit the Elville and Associates YouTube channel to view recordings of our past webinars.

#elvilleeducation #elvillewebinarseriesMany critical mistakes can occur when planning for a loved one with special needs, along with the perils that exist for persons with disabilities when no planning is implemented for them.

Bill Hufnell, Founder and Principal at Bay Point Wealth, and Stephen R. Elville, Managing Principal and Lead Attorney of Elville and Associates, discuss the biggest mistakes in special needs planning, what the ramifications are, and how to overcome and avoid them.

More Webinars from Elville and Associates

The education of clients and their families through counseling and superior legal-technical knowledge is the mission of Elville and Associates. We hold multiple educational events every month. Click to view our calendar of educational webinars and events or visit the Elville and Associates YouTube channel to view recordings of our past webinars.

#elvilleeducation #elvillewebinarseriesUnique tax benefits are available to families who have children with special needs. And thanks to recent changes in the tax code, there are opportunities to save substantial amounts of money at tax time. Thomas M. Brinker, Jr., a professor of accounting at Arcadia University in Pennsylvania, has put together a handy checklist of some potential tax benefits that could be available to families who care for a special needs child.

This list includes the tax benefits that have been available for a while and incorporates updated information from the Tax Cut and Jobs Act of 2017, the CARES Act (passed in March 2020 for COVID relief), and the American Rescue Plan of 2021 that have a direct impact on families with special needs dependents.

Special education

If the special needs child attends a special school (or is in an institution) for the main purpose of alleviating his disability by using the facility’s resources, the cost of the child’s tuition, lodging, meals, and transportation is deductible, as are the costs of supervision and care. Regular independent schools can be classified as “special schools” if the school has a special curriculum for neurologically disabled individuals, and according to IRS regulations, their tuition costs would be deductible.

If the child is receiving private tutoring by a specialized teacher, the IRS has ruled that those fees are deductible, as are tuition fees for special education provided to dyslexic children.

Services and therapies

Prof. Brinker notes that prescribed vitamin and equestrian therapies are deductible, in addition to other group or individual programs such as art, music, dance, and play, and summer camp. It is crucial to get a doctor’s recommendation as part of the necessary paperwork.

Medical expenses

As Prof. Brinker explains, “Unreimbursed medical expenses are deductible only to the extent that the Tax Payer itemizes their deductions (Schedule A) and these exceed 7.5 percent of their Adjusted Gross Income (AGI).” Note that as part of the Tax Cuts and Jobs Act of 2017, the standard deduction was significantly increased, and is $12,550 for individuals and $25,100 for couples in 2021. So only families who expect to spend substantially more than these amounts on medical care for their special needs dependent would benefit from this provision.

For families who plan on itemizing their special needs medical expenses, note that travel costs for medical treatment are deductible as follows: $50 per day of food and lodging for the taxpayer and one other person (if an overnight stay is required), and driving expenses at $.16 per mile.

Also, registration and attendance fees for medical conferences (though not food and lodging) qualify, as long as the conference topic relates to the condition of the dependent with special needs.

Tax-deferred and tax-advantaged accounts

Parents of children with special needs might consider enrolling in a flexible spending account (FSA) through their employer to pay for qualifying medical expenses that are not reimbursed. For 2021, the maximum annual contribution to an FSA is $2,750, and as a provision of the CARES Act, over-the-counter medications are now eligible expenses for FSAs.

Regarding early withdrawals from qualified retirement accounts such as IRAs and 401(k)s, any distributions spent on deductible medical care (i.e., amounts in excess of the 7.5 percent of AGI threshold) for dependents with special needs are not subject to the 10 percent penalty (though they are still subject to income tax).

Other benefits in Prof. Brinker’s checklist include an expanded definition of a qualifying child, who can be older than 19 if shown to have special needs and lives at home. And revised provisions mean changes to the personal and dependency exemption rates and phase-outs, as specified in the Tax Cuts Act of 2017 and the American Rescue Plan of 2021.

To ensure you are taking advantage of all the tax benefits and credits available to you, consult with an attorney whose practice focuses on working with families of special needs children.

If you would like to learn more about the potential tax benefits available to families supporting a child with special needs, check out Prof. Brinker’s checklist and consult with the special needs planners at Elville and Associates, who will partner with you to learn about your situation, answer your specific questions, offer solutions and create a path forward for you. You can reach out to Managing Principal and Lead Attorney Stephen Elville and steve@elvilleassociates.com or by phone at 443-393-7696 x108. Or, you may contact us here.

#elvilleeducation

x

Unique tax benefits are available to families who have children with special needs. And thanks to recent changes in the tax code, there are opportunities to save substantial amounts of money at tax time. Thomas M. Brinker, Jr., a professor of accounting at Arcadia University in Pennsylvania, has put together a handy checklist of some potential tax benefits that could be available to families who care for a special needs child.

This list includes the tax benefits that have been available for a while and incorporates updated information from the Tax Cut and Jobs Act of 2017, the CARES Act (passed in March 2020 for COVID relief), and the American Rescue Plan of 2021 that have a direct impact on families with special needs dependents.

Special education

If the special needs child attends a special school (or is in an institution) for the main purpose of alleviating his disability by using the facility’s resources, the cost of the child’s tuition, lodging, meals, and transportation is deductible, as are the costs of supervision and care. Regular independent schools can be classified as “special schools” if the school has a special curriculum for neurologically disabled individuals, and according to IRS regulations, their tuition costs would be deductible.

If the child is receiving private tutoring by a specialized teacher, the IRS has ruled that those fees are deductible, as are tuition fees for special education provided to dyslexic children.

Services and therapies

Prof. Brinker notes that prescribed vitamin and equestrian therapies are deductible, in addition to other group or individual programs such as art, music, dance, and play, and summer camp. It is crucial to get a doctor’s recommendation as part of the necessary paperwork.

Medical expenses

As Prof. Brinker explains, “Unreimbursed medical expenses are deductible only to the extent that the Tax Payer itemizes their deductions (Schedule A) and these exceed 7.5 percent of their Adjusted Gross Income (AGI).” Note that as part of the Tax Cuts and Jobs Act of 2017, the standard deduction was significantly increased, and is $12,550 for individuals and $25,100 for couples in 2021. So only families who expect to spend substantially more than these amounts on medical care for their special needs dependent would benefit from this provision.

For families who plan on itemizing their special needs medical expenses, note that travel costs for medical treatment are deductible as follows: $50 per day of food and lodging for the taxpayer and one other person (if an overnight stay is required), and driving expenses at $.16 per mile.

Also, registration and attendance fees for medical conferences (though not food and lodging) qualify, as long as the conference topic relates to the condition of the dependent with special needs.

Tax-deferred and tax-advantaged accounts

Parents of children with special needs might consider enrolling in a flexible spending account (FSA) through their employer to pay for qualifying medical expenses that are not reimbursed. For 2021, the maximum annual contribution to an FSA is $2,750, and as a provision of the CARES Act, over-the-counter medications are now eligible expenses for FSAs.

Regarding early withdrawals from qualified retirement accounts such as IRAs and 401(k)s, any distributions spent on deductible medical care (i.e., amounts in excess of the 7.5 percent of AGI threshold) for dependents with special needs are not subject to the 10 percent penalty (though they are still subject to income tax).

Other benefits in Prof. Brinker’s checklist include an expanded definition of a qualifying child, who can be older than 19 if shown to have special needs and lives at home. And revised provisions mean changes to the personal and dependency exemption rates and phase-outs, as specified in the Tax Cuts Act of 2017 and the American Rescue Plan of 2021.

To ensure you are taking advantage of all the tax benefits and credits available to you, consult with an attorney whose practice focuses on working with families of special needs children.

If you would like to learn more about the potential tax benefits available to families supporting a child with special needs, check out Prof. Brinker’s checklist and consult with the special needs planners at Elville and Associates, who will partner with you to learn about your situation, answer your specific questions, offer solutions and create a path forward for you. You can reach out to Managing Principal and Lead Attorney Stephen Elville and steve@elvilleassociates.com or by phone at 443-393-7696 x108. Or, you may contact us here.

#elvilleeducation