[et_pb_section fb_built=”1″ admin_label=”section” _builder_version=”4.16″ global_colors_info=”{}” theme_builder_area=”post_content”][et_pb_row admin_label=”row” _builder_version=”4.16″ background_size=”initial” background_position=”top_left” background_repeat=”repeat” global_colors_info=”{}” theme_builder_area=”post_content”][et_pb_column type=”4_4″ _builder_version=”4.16″ custom_padding=”|||” global_colors_info=”{}” custom_padding__hover=”|||” theme_builder_area=”post_content”][et_pb_text admin_label=”Text” _builder_version=”4.22.0″ background_size=”initial” background_position=”top_left” background_repeat=”repeat” hover_enabled=”0″ global_colors_info=”{}” theme_builder_area=”post_content” sticky_enabled=”0″]By: Stephen R. Elville, J.D., LL.M. – President and Principal Attorney of Elville and Associates, P.C.

The process of estate planning is confusing and ambiguous for some people, and a real obstacle for others. No one really enjoys sitting down and discussing end-of-life issues or incapacity issues, let alone the sharing of personal information with a stranger, not to mention the mystery of the actual process of going to an attorney‘s office. So let’s get something out of the way right up front. Discussing your estate and in capacity planning is not fun. But it can be rewarding.

The process of estate planning is confusing and ambiguous for some people, and a real obstacle for others. No one really enjoys sitting down and discussing end-of-life issues or incapacity issues, let alone the sharing of personal information with a stranger, not to mention the mystery of the actual process of going to an attorney‘s office. So let’s get something out of the way right up front. Discussing your estate and in capacity planning is not fun. But it can be rewarding.

The first step in the process is to understand that there is nothing to fear, and one benefit of engaging in a comprehensive estate planning process is the peace of mind, clarity, and certainty that results. Now, during these challenging days, the issue of process in estate planning has taken on a new meaning and dynamic. Many couples and individuals simply want to implement their estate plans as soon as possible.

To address this concern, Elville and Associates is responding by emphasizing its self-directed programs for wills, trusts, powers of attorney, and advance medical directives – the same dual-track planning approach that has benefited our clients for the past 10 years. In short, this is what it is: for persons who wish to implement an expedited estate plan – to put wills and trusts and incapacity planning documents in place as soon as possible, our estate planning and elder law departments will initiate the drafting and implementation of estate planning documents on an expedited basis, utilizing all available tools and technology. This kind of planning can be viewed as interim or stop-gap measure planning, and for some people this will represent their complete planning package.

Beyond this, the second track of the self-directed approach is the continuation of client education and knowledge. Once the interim plan is executed and immediate concerns have been addressed, the important educational process for clients can continue until completion. In many cases this will include the re-execution of certain documents that address a broader, more comprehensive plan that then replaces the initial temporary plan. In summary, do not be apprehensive or fearful of the estate planning process. Instead, embrace the process and envision the peace of mind that comes from comprehensive planning that is education based. Elville and Associates is committed to meeting the estate planning needs of couples and individuals during this time of crisis and beyond through the use of its leading-edge legal-technical knowledge, technological resources, and client education-based platform.

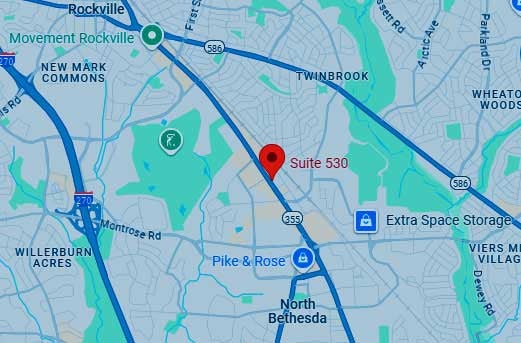

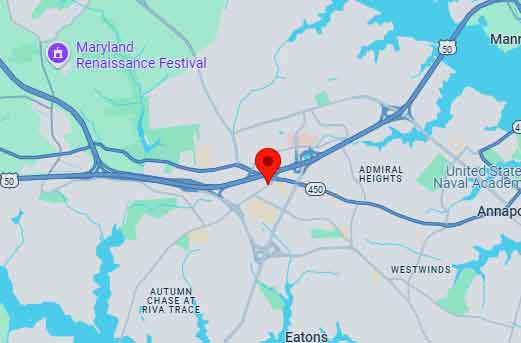

Stephen R. Elville is the principal and lead attorney of Elville & Associates, P.C., a leading estate planning, elder law, and special needs planning law firm in Maryland. Elville and Associates engages clients in a multi-step educational process to ensure that estate, elder law, and special needs planning works from inception, throughout lifetime, and at death. Clients are encouraged to take advantage of the Planning Team Concept for leading-edge, customized planning. The education of clients and their families through counseling and superior legal-technical knowledge is the practical mission of Elville and Associates. If you would like to set an appointment with Mr. Elville to discuss estate or elder law planning issues, you may contact him at 443-393-7696, or via email at steve@elvilleassociates.com. #elvilleeducation[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

By Stephen R. Elville, J.D., LL.M. — Principal and Lead Attorney of Elville and Associates, P.C.

Beneficiary designations can make or break an estate plan. Without proper and accurate beneficiary designations, retirement plan assets can flow in unintended ways causing many potential problems including, but not limited to, the following: loss of lifetime stretch out of required minimum distributions for new class of eligible designated beneficiaries under the SECURE Act; for married persons, inefficient use of the new 10-year rule under the SECURE Act due to the “spousal rollover trap”; loss of designated beneficiary status or eligible designated beneficiary status; triggering of the five-year default rule whereby all plan assets must be withdrawn and taxed within five (5) years – this means that for all practical purposes the entire IRA or qualified plan is taxed immediately; failure of the plan assets to reach and fund important spendthrift trusts for spouses, children, grandchildren, nieces and nephews; failure of your retirement plan assets to reach intended charitable beneficiaries tax-free; and more. Risking failure of your estate plan and/or the acceleration of income tax on your retirement plan assets is just not worth it. Check your retirement plan beneficiary designations today, in consultation with your financial advisor, estate planning attorney, and CPA. Hopefully you will find no surprises. And if you do, you’ll be glad you performed a check up.

Beneficiary designations can make or break an estate plan. Without proper and accurate beneficiary designations, retirement plan assets can flow in unintended ways causing many potential problems including, but not limited to, the following: loss of lifetime stretch out of required minimum distributions for new class of eligible designated beneficiaries under the SECURE Act; for married persons, inefficient use of the new 10-year rule under the SECURE Act due to the “spousal rollover trap”; loss of designated beneficiary status or eligible designated beneficiary status; triggering of the five-year default rule whereby all plan assets must be withdrawn and taxed within five (5) years – this means that for all practical purposes the entire IRA or qualified plan is taxed immediately; failure of the plan assets to reach and fund important spendthrift trusts for spouses, children, grandchildren, nieces and nephews; failure of your retirement plan assets to reach intended charitable beneficiaries tax-free; and more. Risking failure of your estate plan and/or the acceleration of income tax on your retirement plan assets is just not worth it. Check your retirement plan beneficiary designations today, in consultation with your financial advisor, estate planning attorney, and CPA. Hopefully you will find no surprises. And if you do, you’ll be glad you performed a check up.

Are you taking the time to think about this issue?

Stephen R. Elville is the principal and lead attorney of Elville & Associates, P.C., a leading estate planning, elder law, and special needs planning law firm in Maryland. Elville and Associates engages clients in a multi-step educational process to ensure that estate, elder law, and special needs planning works from inception, throughout lifetime, and at death. Clients are encouraged to take advantage of the Planning Team Concept for leading-edge, customized planning. The education of clients and their families through counseling and superior legal-technical knowledge is the practical mission of Elville and Associates. If you would like to set an appointment with Mr. Elville to discuss estate or elder law planning issues, you may contact him at 443-393-7696, or via email at steve@elvilleassociates.com. #elvilleeducation

Family Values as an Inheritance

Successfully addressing and legally formalizing inheritance of family values and assets can be challenging, especially if parents wait too long to begin instilling family values. Undoubtedly the best time to teach and empower your children as eventual inheritors of your family legacy is during childhood, then continuing throughout adulthood. Waiting until your later stages in life to discuss family values as a guide to handling inherited worth is often ill-received as grown adult children prefer not to feel parented anymore, particularly when they are raising children of their own.

There is value in the spiritual, intellectual, and human capital of rising generations, and it is incumbent upon older generations to embrace this notion and work with their heirs rather than dictating to them their ideas about how to facilitate better outcomes. While the directions taken by newer generations will likely differ and can sometimes be downright frightening than that of their elders, there can still be a deep sense of service and responsibility to family values and stewardship of inherited wealth. Allow your children to exert their influence over the family enterprise early on in life and make adjustments that create synergy, connection, and like-mindedness.

If this description of a somewhat ideal family system does not resemble yours, take heart. Most families do not conform to perfect standards of interaction. The more affluent a family is, the higher the failure rate to disperse assets without severe fallout. The Williams Group conducted a 20-year study and determined there is a 70 percent failure rate that includes rapid asset depletion and disintegration of family relationships during and after inheritance. Establishing inheritable trusts can provide real benefits. Benefits include avoiding probate, reducing time to handle estate matters, privacy protection, the elimination or reduction of the estate tax, and can be effective pre-nuptial planning. A parent who wants to control outcomes should focus on these benefits of the trust instead of trying to legislate their future adult children’s behavior.

It is imperative not to allow your values and legacy to become weaponized within the family system. A sure-fire way to inspire conflict is via “dead hand control,” meaning trying to control lives from the grave. Most often, if you put excessive trust restraints on adult children, they will act accordingly to your perception that they are not adult enough to handle wealth. Instead, consider enrolling them in a few classes about managing wealth. Spark an interest in them to learn how you have created wealth, the mechanisms you used, and what their future endeavors may look like long after you are gone. Formally educate your children about finances, the earlier the better, and instead of talking about who gets what the conversation can shift to the mechanics of managing wealth. This tactic resets the context of the issue and aligns purpose and intended long term outcomes.

Estate planners try to encourage trust choices that lead to flexibility. If a beneficiary is genuinely incapable of making the right decisions, a trustee can be appointed to make distributions in the beneficiary’s best interest. This trustee discretionary power of money management can help a well-funded trust survive for generations.

You can also write a letter of wishes or provide a statement of intent to your children. Though these are not legally binding, it gives you a platform to remind them of family values and your desire for these values to be maintained for future family generations. This type of letter is an opportunity for you to convey your vision for how your wealth can bring growth and chance for fulfillment to beneficiaries.

Prosperity should positively shape lives. Family trust beneficiaries hopefully already have a self-driven life that includes purpose, responsible behavior, and a basic understanding of personal finance. If you worry your children may squander inheritable assets, create the opportunity for them to succeed through classes that teach them about managing legacy family values and wealth. Address your concerns legally and directly through a detailed trust that can help but not overly constrain them to achieve what you envision they can become. Start an honest conversation early on, but remember it is never too late to make good choices and create positive family value influences for the coming generations. A well-known Ann Landers quote sums it up neatly, “In the final analysis it is not what you do for your children but what you have taught them to do for themselves that will make them successful human beings” – a worthy goal of any family value system.

If you are interested in establishing a trust to pass wealth on to your children, we can help. We can also guide families on how to pass on family values in a meaningful way.

If you have questions or need guidance in your planning or planning for a loved one, please do not hesitate to contact any one of our five office locations by calling us at (443) 393-7696.

New Insights on Parkinson’s Disease Revealed

Parkinson’s disease is a neurodegenerative disorder that causes a progression of symptoms including, body tremors, limb rigidity, Bradykinesia (slow movement), as well as balance and gait problems. The cause of Parkinson’s disease (PD) remains largely unknown. One well-known indicator of PD is the dying off of predominately dopamine-producing neurons (dopaminergic) in a particular region of the brain. While the disease is not itself considered to be fatal, serious complications can occur. The Center for Disease Control and Prevention (CDC) lists complications from Parkinson’s disease as the 14th leading cause of death among Americans. Official estimates for 2020 estimate that approximately 930,000 people age 45 or older will be living with the disease.

Current Biology has recently published a comprehensive new study that explores the root cause of Parkinson’s disease and looks to develop disease modification therapies instead of the pharmacological treatment for the disease’s symptoms. Current therapies include dopaminergic medications to replace missing dopamine or increase low levels of dopamine in the brain. All pharmacological therapies to date only improve PD symptoms but are unable to slow or halt the disease progression, and long-term use of these medications can lead to serious side effects.

Prevailing notions about the key biological mechanisms of Parkinson’s may be overturned as motor symptom degeneration may occur because of brain changes far earlier than researchers had previously surmised. Lead researchers C. Justin Lee, Ph.D., Hoon Ryu, Ph.D., and Sang Ryong Jeon, in conjunction with other colleagues, all in South Korea, identified that symptoms of the disease appear before the premature death of the dopamine-producing neurons. What the researchers found is that dopaminergic neurons cease to function properly before they die off. While the effect is the same, symptoms associated with Parkinson’s, the biomarker shift is profound.

Surrounding astrocytes (star-shaped non-neuronal cells) in the same region of the brain show an increase in number as the local neurons begin to die off. A key chemical messenger, known as GABA, also starts to increase its levels in the brain. GABA is what stops the dopaminergic neurons from producing dopamine; however, it does not kill them. Parkinson’s disease mechanisms, in its earliest stages of brain change, can allow for dormant neurons to be awakened, and they can resume the production capability of dopamine. The stopping of astrocytes from synthesizing excessive GABA decreases the severity of motor symptoms. Theoretically, addressing Parkinson’s at this early stage can prevent neuronal death of dopamine producers and prevent the disease from occurring at all. This theory is no less than a weighty shift from responsive pharmacological therapy treating symptoms to disease modification or possibly eradication at its root cause.

Disease-modifying treatments become more prevalent as our ability to advance our understanding of the human brain mechanisms increases. Researchers who are capable of rethinking traditional disease model understanding are at the forefront of this disease modification trend. Sang Ryong Jeon, “However, this research demonstrates that functional inhibition of dopaminergic neurons by surrounding astrocytes is the core cause of Parkinson’s disease. It should be a drastic turning point in understanding and treating Parkinson’s disease and possibly other neurodegenerative diseases as well.”

This study advances our understanding of the underlying brain activity that triggers Parkinson’s and gives hope that better treatments will be developed. Changing the point at which medical identification and intervention for disease modification are crucial to eradicating Parkinson’s. Until such time, current pharmacological therapies must remain in place for those people currently afflicted with PD as once neuronal cells die off, scientists have no way of switching it back to life.

We help families who have loved ones with serious health conditions, like Parkinson’s’. It’s important to have a comprehensive estate plan that covers long term care issues as well as payment options for care. Please get in touch with any of our five offices by giving us a call at (443) 393-7696 if you’d like to discuss your situation and how we can help.

Taking Steps to Protect Your Child’s Inheritance

Estate planning for the future inheritance of your children and grandchildren should include protective measures to keep assets from disappearing or being claimed by a creditor. A simple way to achieve inheritance protection is through a trust. A trust can pass your wealth bypassing probate. This allows specific trust provisions to ensure the money left to a beneficiary is neither squandered or through ill-advised spending or divorce action of the beneficiary.

Divorce is one of the primary obstacles to contend with when trying to minimize issues of wealth transfer and preservation. High divorce rates, especially among aging Americans, can make an inherited trust vulnerable if the property becomes commingled with the marital estate. Single and married children, as well as grandchildren of inherited wealth, should always maintain inherited assets and property as a separate entity whether as a trust or direct individual inheritance. Before any marriage, a pre-nuptial agreement should be signed to protect previously inherited wealth and the potential of future inheritance.

Whether your child or grandchild inherits an existing trust or establishes their trust after a direct bequeath, the terms of the trust can limit the potential problem of future loss of inherited monies or assets due to the possibility of lawsuits and creditor claims. A properly drafted trust can protect assets from legal action in the event your child is sued. A trust also protects the trust maker and the beneficiaries from the public process of probate. Anyone can research probate court records and determine how much your estate was worth, what you owned and how you chose to divide it.

If you believe your adult child has limited aptitude to manage money properly and might squander your grandchildren’s inheritance, then draft a will or trust that earmarks a dollar amount or percentage of the estate for those grandchildren explicitly. As an example, the will or trust can also specify that these inherited assets be allocated solely for a grandchild’s college education or wedding.

Another financial vehicle with some overspending controls is a “stretch IRA.” This inherited individual retirement account (IRA) has a required minimum distribution (RMD) that stretches over a more extended period based on the inheritor’s life expectancy. A monitored minimum distribution will allow the principal to continue growing. In the case a child or grandchild is too young to manage the RMDs it may be in their best interest to name an institutional trustee to direct distributions.

Whatever your intent is for your grandchildren, be sure to include a discussion with your child, expressing your resolve for your grandchildren to inherit and clearly stating them in your will. Also, speak honestly about your fears that your child may blow through their inheritance and discuss the value of limiting annual distributions to only investment income or a percentage of the trust’s value to preserve the aggregate of assets. In the event your child, who may have an addiction problem like gambling, drugs, or overspending, may require trustee oversight to temporarily end the distribution of trust or IRA monies until they demonstrate wellness. At that time, the trustee may opt to restart money distributions.

Ultimately it is best to find a trusted estate planning attorney that is well versed in the laws of your state to help you craft a comprehensive approach to the dispersion of your estate that will protect your intentions from the mal-intent of others. Whether you need a lifetime “dynasty” trust, individual trust or direct inheritance, institutional trustee, inheritable stretch IRA, or a combination of inheritance vehicles, is all dependent on your unique financial position and personal desires for your legacy’s distribution. There is great latitude when drafting the structure for the distribution of your estate, so look to creative inspiration to open up possibilities.

If you have any questions or need guidance in your planning or planning for a loved one, please don’t hesitate to contact any one of our five offices by calling (443) 393-7696.

Should Children Pitch in for Elder Care?

The astronomical expense of long-term nursing care is no longer news. Costs can run around $7,000.00 or more per month, depending on location. Hundreds of thousands of people presently need that kind of care and the numbers are rising. Ten thousand “baby boomers” a day turn 65, and it’s projected that seven of ten of those people will need long-term care.

By astute financial planning, our law firm reduces or eliminates the impact of such phenomenal costs on many families’ life savings. But many others who are not our clients pay and pay until they simply run out of money. The Medicaid program is available to step in and pay, but it is questionable how long that program can continue in its present state. For 2018, Medicaid spending was at $597.4 billion, according to the Centers for Medicare and Medicaid Services. Policy-makers are looking for other alternatives.

One option is to require adult children to pay for the cost of their parents’ care. This obligation can be imposed through “filial responsibility” laws. Around thirty states have enacted these laws, some of which even impose criminal fines and imprisonment if an adult child is able, but fails, to pay.

In Pennsylvania in 2012, a son whose mother owed $93,000 to a nursing home was held liable for her bill under that state’s filial responsibility law. The case is Health Care & Retirement Corp. v. Pittas, available here.

The rationale for such laws is that parents supported children for many years and the children owe a debt of gratitude: they should return the favor when parents grow old and become unable to provide for themselves. Such laws are supposed to motivate children to exert pressure on parents, to ensure that long-term care planning is done before the children are called on to pay.

There are numerous objections to this kind of law. Children may resent being forced to pay and treatment of the elderly may suffer as a result. The laws differ widely across the states and produce inconsistent results. Courts may not have the power to enforce these laws against children who live in disparate states. Filial-responsibility laws provide no protection for seniors who have no children.

Further, federal law currently prohibits nursing homes from demanding payment from funds other than those belonging to the resident – like a child’s money.

Other alternatives are more-wisely designed to care for elderly people at home, to delay the need for institutional care for as long as possible. In-home care is estimated to cost one-third the amount of institutional care. Further, personal care can be more suited to the individual if it is given by family and community caregivers. The emotional benefit to the elder can be incalculable.

The need for such programs has been recognized by the Affordable Care Act, which greatly expanded options for states to increase funding for home- and community-based services. Additionally, there are HUD funds available for projects like ECHOs (elder cottage housing opportunity units) – “granny cottages,” small houses for the elderly on a child’s property, to keep family help close by. A 2003 study on the results of that program is available here.

Additional tax deductions and exemptions, like those already allowed in the Medicaid rules, could provide more incentives for at-home improvements like wheelchair ramps and grab-bars. Easing qualifications for long-term care insurance deductions could be encouraged. Family and medical leave from employment could become more available, to relieve the caregiving burden that currently rests disproportionately on women and low-income workers. Subsidies to community elder-care services could be beefed up.

The problem of paying for elder care is multi-faceted and should be tackled on numerous fronts. The options other than filial-responsibility laws seem better-advised to relieve the Medicaid program from the stresses it faces now and into the future.

If you have any questions or need guidance in your planning or planning for a loved one, please don’t hesitate to contact one of our five offices by calling (443) 393-7696.

All You Need to Know About Long Term Care

Americans are facing an escalating long-term care (LTC) crisis. Industry driven, massively underpriced policies are playing fiscal catch up with hefty premium rate increases. This price increase is forcing some aging Americans to abandon their policy while others struggle to reduce their amount of LTC coverage to keep their rates affordable or reduce their future lifestyle by dipping into their retirement savings. Abandoning LTC policies turns out to be the last resort for many policyholders as they understand how valuable they are and that a policy lapse would cause them to lose all of their monies paid to the insurer.

Throughout the insurance industry, the metrics applied to the long-term care business model underestimated how long policyholders would live and the number of claims they would submit. Policyholders are living years longer than the actuaries had projected. Compounding the crisis of this flawed business model is years of very low-interest rates. On an inflation-adjusted basis, return on investment has fallen vastly short of needs for all long term investors, including pension funds, life insurers, and the average American saving for retirement. The financial fallout is that fewer people are seeking long-term care insurance policies and those that are, typically pay more and receive less coverage.

Further compounding long-term care problems is the escalation of Alzheimer’s diagnoses and other dementia diseases, which invariably increases an individual’s need for long-term care. Medicare does not make provisions for coverage in long-term care facilities. Even if you position yourself financially to qualify for Medicaid, which does provide for LTC, there is often a long waiting list and reportedly not a high standard of care when you become a resident.

Senator Patrick Toomey (R-PA) is preparing legislation that includes a clause to allow people to pay for long term care insurance via a tax-free withdrawal from their 401(k) retirement plan. The withdrawal, up to 2000 dollars a year, would not be subject to income tax, and the limit would be indexed for inflation over the years.

The Internal Revenue Service is also trying to offset tax liabilities for Americans that cover long term care insurance premiums in 2020. There is a range of tax-deferred dollar amounts depending on your age, and this information is posted on the American Association for Long-Term Care Insurance website.

Relying on the federal government to fix the long term care crisis is a cautionary tale. McKnight’s Senior Living reports that the LTC sector typically gets very little play in Washington, DC. Hospitals, doctors, insurance companies, and drug companies with big lobby monies are far more likely to receive legislative attention, often to the demise of long-term care operators and the vulnerable American population they support. Beyond the untenable high costs of LTC premiums, excessive administrative costs burden the US health care system. Washington DC, notorious for its complex, plodding policy progress, will not likely address the situation beyond creating tax-deferred access to retirement accounts and other tax incentives. Instead, the government is okay to allow the paying public to absorb the high costs of long-term care as the industry sector tries to salvage itself.

One of the worst outcomes of these scenarios is that long-term care has become such an expensive problem that Americans are shying away from proactive planning to address the very likely need they will require long-term care insurance in their future. The US Department of Health and Human Services has a website that addresses long-term care basics and provides resources, tools, and links to guide your LTC planning.

Other solutions can provide the essentials for long-term care packaged in different insurance programs. Short-term care insurance, or convalescent insurance, provides a long-term care type of coverage for 180 to 360 days. Because there is no long- term commitment to the insurance companies, premiums usually are less than traditional LTC. Critical-care or critical-illness insurance are two similar types of insurance coverage offering lump-sum cash payments to those who are diagnosed with a stroke, heart attack, and other serious illnesses. The benefits range can be six months up to two years, depending on the company and policy chosen. The drawback to these insurance policies is they do not cover pre-existing conditions. Deferred annuities for after retirement and annuities with long-term care riders can also be alternative solutions to traditional LTC insurance.

The time to get proactive and creative about long-term care insurance is now. Current statistics may give a false sense of security regarding the likelihood you will need long-term care. Projections are indicating between 65 to 75 percent of Americans will require some level of long-term care after retirement. The unspoken truth that many within the LTC industry and government do not address publically is that if the problem is not resolved, it will still ultimately go away because the person who receives sub-standard or no care will die. The idea that aging Americans would be allowed to languish without proper care when they are at their most vulnerable is unthinkable from a human standpoint. Pro-active planning to find a long term care solution is essential to your future health and financial well-being.

We can help you put a plan in place that includes accessing and paying for appropriate long term care. We can review potential programs to help offset some of the costs while creating a legal plan to protect your assets from the high costs of care.

If you have any questions or need guidance in your planning or planning for a loved one, please don’t hesitate to contact one of our five offices by dialing (443) 393-7696.

On December 20, 2019, President Trump signed the Setting Every Community Up for Retirement Enhancement Act (SECURE Act). The SECURE Act, which is effective January 1, 2020. The Act is the most impactful legislation affecting retirement accounts in decades. The SECURE Act has several positive changes: It increases the required beginning date (RBD) for required minimum distributions (RMDs) from your individual retirement accounts from 70 ½ to 72 years of age, and it eliminates the age restriction for contributions to qualified retirement accounts. However, perhaps the most significant change will affect the beneficiaries of your retirement accounts: The SECURE Act requires most designated beneficiaries to withdraw the entire balance of an inherited retirement account within ten years of the account owner’s death.

The SECURE Act does provide a few exceptions to this new mandatory ten-year withdrawal rule: spouses, beneficiaries who are not more than ten years younger than the account owner, the account owner’s children who have not reached the “age of majority,” disabled individuals, and chronically ill individuals. However, proper analysis of your estate planning goals and planning for your intended beneficiaries’ circumstances are imperative to ensure your goals are accomplished and your beneficiaries are properly planned for.

Under the old law, beneficiaries of inherited retirement accounts could take distributions over their individual life expectancy. Under the SECURE Act, the shorter ten-year time frame for taking distributions will result in the acceleration of income tax due, possibly causing your beneficiaries to be bumped into a higher income tax bracket, thus receiving less of the funds contained in the retirement account than you may have originally anticipated.

Your estate planning goals likely include more than just tax considerations. You might be concerned with protecting a beneficiary’s inheritance from their creditors, future lawsuits, and a divorcing spouse. In order to protect your hard-earned retirement account and the ones you love, it is critical to act now.

Review/Amend Your Revocable Living Trust (RLT) or Standalone Retirement Trust (SRT)

Depending on the value of your retirement account, we may have addressed the distribution of your accounts in your RLT, or we may have created an SRT that would handle your retirement accounts at your death. Your trust may have included a “conduit” provision, and, under the old law, the trustee would only distribute required minimum distributions (RMDs) to the trust beneficiaries, allowing the continued “stretch” based upon their age and life expectancy. A conduit trust protected the account balance, and only RMDs–much smaller amounts–were vulnerable to creditors and divorcing spouses. With the SECURE Act’s passage, a conduit trust structure will no longer work because the trustee will be required to distribute the entire account balance to a beneficiary within ten years of your death. We should discuss the benefits of an “accumulation trust,” an alternative trust structure

Unpacking the SECURE Act of 2020

Congress has passed a bipartisan appropriations bill. In the contents of this spending bill is a piece of legislation known as the Setting Every Community Up for Retirement Enhancement Act (SECURE), the first significant change in retirement legislation since the Pension Protection Act in 2006. The President signed the Act into law on December 20, and its effective date is January 1, 2020.

The impact of the SECURE Act to some retirees, near-retirees, and their future beneficiaries is profound, and it is imperative to schedule a review of your retirement, estate, and trust plans. Failure to act on the changes brought forward by the SECURE Act can create substantial tax burdens for some beneficiaries and even the possibility that they become locked out of their inheritance for a decade.

One of the most important provisions of the SECURE Act to understand is the removal of the stretch IRA required minimum distribution (stretch RMD). In essence, the removal will act as a tax revenue generator. This change means many Americans will face a tax increase as non-spouse beneficiaries must spread withdrawals over a maximum of ten years and not the lifetime of the account holder. The removal of the RMD for stretch IRAs is going to create significant problems for certain types of trusts, like the “see-through trust,” that were written before the SECURE Act. Previously, a see-through trust allowed an individual, upon their death, to pass retirement assets of their IRAs via a trust to a chosen beneficiary. If the trust is not updated to match the current SECURE Act language, there could be restrictions in accessing funds to the heirs, which may cause massive tax liabilities down the line.

Annuities are also affected by the SECURE Act as the legislation will ease restrictions to include them in consumers’ 401(k)s. While this is a positive for lifetime income, the bill also lessens and even removes some of the fiduciary requirements to vet insurance companies and their financial products before allowing them into your 401(k) plan. This change, coupled with a reduction in overall standards the SEC imposed earlier this year, creates an increased likelihood that consumers could experience negative consequences from poorly designed financial products and the possibility of insurance company failure.

According to Forbes, there are eight significant ways the SECURE Act will impact your retirement plans. They include an increase in ability for small employer access to retirement plans, an increase in annuity options inside of retirement plans, an increase in required minimum distribution (RMD) ages, and the removal of age limits on IRA contributions. There is also a tax credit to encourage automatic enrollment into retirement plans through small employers, penalty-free distributions for childbirth or adoption, lifetime income disclosure for defined contribution plans for transparency, and the removal of stretch inherited IRA provisions.

It is imperative as an individual to be responsive to the changes this proposed new law will enact. Currently, estate attorneys, CPAs, and financial advisors are receiving additional training to understand the long-term tax implications of SECURE Act provisions. For those affluent retirees, Kiplinger advises there are five things you can do immediately to respond to the SECURE Act. The first is to delay your IRA distributions if possible, and continue to save but perhaps not in an IRA. Also, consider paying taxes BEFORE your children inherit your IRA. Talk to your financial planner, tax advisor, and revisit your existing estate planning documents to make sure the plans don’t compromise any existing IRAs that will be passed on to your beneficiaries.

The overall implications of the SECURE Act to your retirement and your estate plan are numerous. Give us a call to discuss how we can help make sure your retirement assets pass with as few tax consequences as possible.

You can get in touch with any of our five offices by calling (443) 393-7696.

Divorce’s Affect on the Aged Population

Americans aged 50 or more are experiencing gray divorce more than ever. The term gray divorce generally refers to the baby boomer generation and affects all classes and education levels. Research shows that splitting during middle age is particularly damaging to your financial well being. According to Bloomberg News, the US divorce rate for couples past the age of 50 has doubled since 1990 and occurs most often in people who have married and divorced more than once. The rate of divorce among remarried individuals is 2.5 times higher than those in first marriages. And the financial outlook is usually the bleakest for those who have married and divorced more than once. Losing accumulated wealth for a second or third time can ruin personal finances on an unprecedented scale.

As such, relative wealth can be a protective factor in keeping couples together. Midlife marriages are not always torn apart by empty nest syndrome or a late mid-life crisis. Often, divorcing couples are already experiencing financial problems due to unemployment or job insecurity. These couples may not have the resources to enter into marriage counseling and may not see the point in fighting to remain in an unsuccessful economic partnership. Married couples with more to lose in divorce will often keep a less than perfect marriage viable to protect a lifestyle they are unwilling to forfeit. These couples will often live separate lives but maintain the economic structure within the marriage.

Susan Brown, who is co-director of the National Center for Family & Marriage Research, explains that if you are getting a divorce after the age of 50, expect your wealth to decrease by 50 percent. Brown goes on to state that the depression rate for those experiencing gray divorce is higher than the levels of those who have experienced the death of a spouse. If you are a woman and going through a gray divorce, expect your standard of living to plunge by 45 percent compared to a man’s 21 percent. One of the biggest financial tragedies of gray divorce is there is no appreciable window of time to recover the wealth you lost. The event horizon of your life is shrinking, and there is no time to undo the financial destruction. Even qualified career individuals will find ageism is rife within the corporate hiring sector. The prospects for landing a great new job or winning a lottery are very bleak. Statistics show you will be most unlikely to recoup your previous standard of living. This fact is particularly true in the case of women aged 63 or more who, in part, are experiencing poverty rates of 27 percent because of gray divorce. The Journal of Gerontology projects that by the year 2030, more than 828,000 Americans will be divorcing each year even if the gray divorce rate stays the same.

What to do if you become a gray divorce statistic then? One of the best ways to recover is to re-partner. Many older people are looking to re-couple and the digital age is providing more ways to meet than ever before. Online dating sites for older Americans are popular as are the more traditional senior community centers to make connections to like-aged people. If you choose to remain un-partnered however, you can expect to take about four years to end the depression cycle of gray divorce. However, remarrying or re-partnering will end the depression almost immediately with the stipulation you have chosen your partner wisely. Generally, re-partnering is more successful if you are a man since they tend to look for a partner who is significantly younger than themselves. As women live longer than men and because men do tend to seek younger women, older women are left with a vastly smaller pool of potential partners.

Protect your well being and financial interests from gray divorce. Your best hope is to stay successfully married and continue on the path of building wealth and enjoying retirement years. If you find yourself going through a gray divorce, be sure to seek trusted legal counsel who can best advise you on how to protect your assets and future retirement years. Whether you are on your first, second, or third marriage take a look at how best to protect your financial picture in the event gray divorce happens to you.

Contact one of our five offices today by calling (443) 393-7696 and schedule an appointment to discuss how we can help you with your planning.