The Financial Planning Aspects of Estate Planning

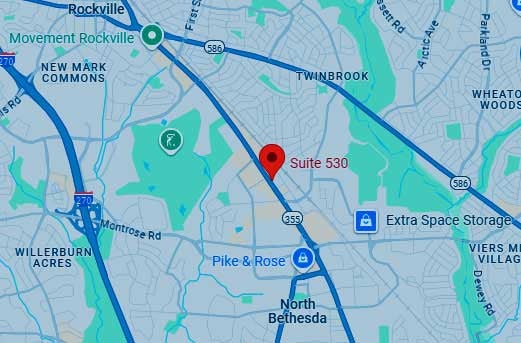

By: Olivia R. Holcombe-Volke, J.D. – Senior Principal and Estate Planning Team Leader – Elville and Associates, P.C.

Initially, my thoughts on this topic – “Financial Planning Aspects of Estate Planning” – were to elucidate and emphasize the importance of working with a financial planner (as well as a tax planner) as part of the estate planning process. I find that many potential clients with whom I meet do not yet have a financial or tax planning professional as part of their growing cadre of advisors, and some even (innocently, but mistakenly) expect that I will be able to provide such guidance and expertise. However, as I further developed this idea, I realized that the topic of the “Financial Planning Aspects of Estate Planning” covers much more than just that one important piece – and there is a lot more that I want to say when trying to explain the vital role that financial planning plays in any successful estate plan, and why, and how.

As is true with the subject matter of “estate planning,” I find that, while many people may have a vague sense of what “financial planning” means, it can be useful to start with a basic description. At its core (and, keeping in mind that, as previously indicated, I myself am not a financial planner, so this is a very basic description), financial planning involves performing an analysis of personal life circumstances (including family, health, age, life stage, etc.), taking into account goals, and tolerance for risk, and determining how, amongst the choices available for investments and uses of assets, when combined with appropriate budgeting and tax planning, someone can achieve personal financial goals. In sum? It involves planning for and ensuring that the necessary sources of assets exist to adequately fund lifetime and after-death goals.

When juxtaposed to this, it is interesting to see how similar the structural description of “estate planning” is. Estate planning involves performing an analysis of personal life circumstances (family, health, age, life stage, etc.), and taking into account goals, and tolerance for risk, as well as the financial/asset picture (i.e. what assets comprise the estate?), and determining how, with the appropriate legal documents and structure, someone can achieve personal estate planning goals. In sum? It involves planning for and ensuring that the necessary legal structures are in place to accomplish lifetime[1] and after-death goals. All of which sounds remarkably similar to the basic structure and description of financial planning.

Thus, the financial planning aspects of estate planning can best be described as 1) determining if you have sufficient assets (perhaps of particular types and structures) to accomplish your estate planning goals, and 2) ensuring that your assets are structured properly with your estate planning documents to successfully accomplish your goals.

This latter point is called “asset alignment,” and it is a vital and often overlooked aspect of estate planning. Thorough and accurate asset alignment is absolutely necessary for the success of an estate plan. Its importance truly underscores the utility of working with professional financial advisors, tax, and estate planning advisors, who will have the knowledge and ability to assist in the necessary alignment of assets, to ensure that a client’s goals and intentions don’t end up suffering from failure due to entirely innocent missteps on the client’s part, based upon common misconceptions regarding how asset structures work in terms of lifetime access and after death distribution.

An example of one such common misconception is that a Last Will and Testament document covers every asset that someone might own – that is, that what the Will says will apply to every asset owned by the person signing the Will. This, in fact, may not, and regularly, is not, true. For example, how an asset is titled will have an impact on whether or not the Will applies to it. Is the asset owned individually, or is it owned jointly with another person (or multiple people)? Furthermore, if an asset has a beneficiary designation, or a Payable on Death (POD) or Transferable on Death (TOD) designation, this will have an impact on whether (and how) the Will applies to it. Thus, depending upon the answers to these asset specific questions (and more), an individual’s Will may not actually apply to and control the distribution of everything that individual owns. Without taking a comprehensive look at both the estate planning goals AND the assets and how they are structured, the assets may not in fact correlate with the plan in the manner that is believed or intended.

Another example of common and entirely innocent missteps that can occur when actions are taken without the assistance of professional advisors, or, more specifically, without a thorough understanding of the financial planning aspects of estate planning, is with regard to a seemingly simple action (adding someone else’s name onto an account or property) with the potential for grave and unintended consequences. Many people conclude that they do not need formal or complicated estate planning documents, but will instead skirt that necessity by simply adding someone’s name (like their adult child) to their accounts or real estate. The risks of which most people are unaware is that by adding someone’s name to an asset, you are also adding exposure of that asset to that person’s creditors (of which the most common ones are divorce and car accidents) – not to mention possible gift and capital gain tax consequences (among other things).

A successful estate plan is one that includes the necessary legal documents AND the comprehensive alignment of assets with those legal documents (and the goals covered therein). None of this is intended to imply that a successful estate plan is one without any reliance on Payable on Death/Transferable on Death or other beneficiary designation structures, or joint ownership of property. Rather, the point is that a successful estate plan requires a comprehensive review and understanding of how the various assets and legal documents and structures work, to ensure that they are structured to successfully work together in the desired and intended manner. Not to mention that taking financial planning into account in conjunction with estate planning can go a long way toward ensuring tax minimization and avoidance, asset protection, the use of the most appropriate assets to accomplish particular goals (charitable goals, for example), and adequate preparation for an unknown future with regard to potential healthcare needs and costs.

[1] An oft overlooked reality of estate planning is that it is not isolated to what happens after death. It also addresses what, whom, and how you want your physical and financial realities handled if you are alive but incapacitated (or otherwise need assistance) for any reason.

To listen to and watch this year’s April 22nd webinar I presented on this topic, please visit our website’s “Webinar Recordings” section or click the link here.

Ms. Olivia Holcombe-Volke is the Senior Principal, Estate Planning Team Leader and member of the Executive Management Team of Elville and Associates. She handles all aspects of estate planning, including the initial drafting of wills, trusts, advance directives, and powers of attorney, as well as the continued revision and updates of those documents as life and statutory changes occur. She also regularly works with clients who have elder law and/or special needs concerns, whether on behalf of themselves or a family member, assisting with Medicaid and Veteran’s asset protection efforts, special needs planning, and the difficult issues attendant to mental and physical incapacity. Olivia can be reached at olivia@elvilleassociates.com, or 443-393-7696 x120.

The SECURE Act: One Year Later – How Will It Impact Your Estate Planning and Retirement?

The Setting Every Community Up for Retirement Enhancement (SECURE) Act is one of the most significant pieces of retirement legislation in more than a decade. On March 7, 2020 at Elville and Associates’ Client Care Program continuing legal education event, the firm’s Managing Principal and Lead Attorney, Stephen Elville, stated that the SECURE Act, and the income tax ramifications it has for most of our clients (mainly, the acceleration of income tax to beneficiaries of inherited IRAs), is arguably the most important tax and asset protection issue clients have been presented with in the past 10 years. In his view, there are basically two main issues (or questions) clients and their families need to address. They are: (I) determine whether any changes need to be made to your estate planning documents; and (II) determine whether you wish to (or should) address the income tax and other impacts of the SECURE Act on your retirement plan assets, your non-exempt beneficiaries, and your estate plan as a whole, including the acceleration of income tax to your beneficiaries, loss of tax deferral to your beneficiaries, and potential loss of asset protection to your beneficiaries.

Mr. Elville will discuss The SECURE Act – One Year Later, and how it will impact your estate planning and retirement. Key topics for discussion include:

• Limiting Stretch IRAs

• Annuity allocations in 401(k)

• No IRA contribution age limit

• Small employer retirement plans

• RMDs, required minimum distributions, at age 72

• Expansion of 401(k) plan participation to more part-timers

• More informative statements for defined contribution plans

• Limited penalty-free distributions on birth or adoption of a child

• Acceleration of RMDs for most inherited retirement accounts

• “Kiddie tax” provision

• Expansion of section 529 plans

More Webinars from Elville and Associates

The education of clients and their families through counseling and superior legal-technical knowledge is the mission of Elville and Associates. We hold multiple educational events every month. Click to view our calendar of educational webinars and events or visit the Elville and Associates YouTube channel to view recordings of our past webinars.

A $1 Million Charitable Endowment? A Message from the Elville Center for the Creative Arts

By: Stephen R. Elville – President and Founder of the Elville Center for the Creative Arts, Inc.

Good news is rare these days, but not at the Elville Center for the Creative Arts. The Elville Center is boldly continuing its work in 2021 to provide much needed musical instruments, music lessons, art- and dance-related activities, and cultural experiences to children and schools throughout Maryland. How big is the need? Huge.

How many teachers, schools, and children need help? Hundreds and thousands. How much work is there to do? A lifetime’s worth. How are these projects being funded? Through generous individual donations of instruments and funds to refurbish those instruments, monthly donations, and annual charitable contributions. What is needed now? A $1 million charitable endowment to permanently fund the Elville Center that will turbo charge an expansion effort to affect many more children’s lives and reconstitute the music programs of many schools whose programs have been decimated or eliminated.

A 501(c)(3) nonprofit corporation, the Elville Center needs your support to achieve its goal of an initial $1 charitable million endowment so that its mission and vision may be perpetuated, expanded throughout Maryland, and nationally. if you would like to contribute to or discuss a charitable endowment the Elville Center, or if you would like to volunteer your services, please contact Executive Director Jeffrey Stauffer at 443-393-7696 x117, or at jeff@elvilleassociates.com. If you would like to speak with the Elville Center’s founder, Stephen Elville, please contact his Legal Administrator, Mary Guay Kramer, at mary@elvilleassociates.com.

By their very nature, special needs trusts (SNTs) are usually designed to terminate, or at least radically change, when the trust’s primary beneficiary dies. But terminating a special needs trust is not as simple as merely writing a check to the remainder beneficiaries and calling it a day. There are several key considerations and requirements to keep in mind.

What happens to the money when the trust is terminated?

The trustee is responsible for terminating the special needs trust and fulfilling the instructions laid out in the trust document. These include filing the trust’s final tax return and paying any income taxes due. (Learn more about paying taxes when a special needs trust is terminated.) There may be other expenses, too, such as funeral and burial costs.

If the trust is a first-party trust – a trust funded with the person with special needs’ own assets — it will owe money to the state if the person with special needs received Medicaid benefits during her lifetime. In what is known as a pay-back provision, the first-party trust must reimburse the state, dollar-for-dollar, for all Medicaid expenses incurred throughout the beneficiary’s life on the death of the beneficiary.

What happens to any remaining assets after the trust is terminated?

If the trust has designated secondary, or remainder, beneficiaries, the assets would pass to them once taxes and expenses have been paid, according to the language of the trust. Although many trusts specifically name the remainder beneficiaries (i.e., “25 percent of the trust shall go to Jane, 75 percent to Mary”), in other cases the trust names only a class of beneficiaries (“the donor’s grandchildren will share the remainder of the trust funds equally”). It is up to the trustee to determine the identities of any unnamed remainder beneficiaries when terminating the special needs trust, contact all the beneficiaries, and make arrangements to distribute the trust funds to them. If any of the remainder beneficiaries are young or have special needs of their own, when terminating the special needs trust it may allow the trustee to retain the trust funds for the benefit of those particular beneficiaries under terms that may be quite similar to those found in the original trust.

Is it possible to change secondary beneficiaries?

This depends on the wording and terms of the trust. When terminating the special needs trust, the trust may have an “amendment provision,” which gives the trustee some flexibility to make changes to the trust. This could include changing the remainder beneficiaries through a provision known as “power of appointment.” If the trustee (or perhaps even the beneficiary himself, depending on the trust language) has power of appointment, he can create a document to change who will receive the assets in the special needs trust on the death of the primary beneficiary. A variation is the limited power of appointment, which, though more restricted, would still allow the trustee or beneficiary to make changes.

What if secondary beneficiaries are not fit to inherit the trust’s assets?

The secondary beneficiary may be a minor, a person with disabilities, or struggling with drug or alcohol addiction. Depending on the terms of the trust, the trustee may have some authority to change the distribution of funds to such remainder beneficiaries. The trustee may, for example, hold the assets in a special account, under a rule known as a “flexible distribution provision.” In this way, the trustee has discretion to act in the interests of the secondary beneficiary while safeguarding the assets within the trust itself.

Special needs trusts are designed to provide funds over a long period of time, to care for the primary beneficiary for the entirety of her life. Many things can change over this period, so it is vitally important that the trust is carefully constructed to take all this into account. Likewise, the trustee must understand the terms and provisions of the trust thoroughly, during the beneficiary’s lifetime and at the time of terminating the special needs trust.

For more detailed information pertaining to your circumstances, it is very important to partner with a law firm that specializes in the area of special needs planning and understands the nuances associated with it. Founded in June 2010, by Stephen Elville, J.D., LL.M., Elville and Associates is an estate planning, elder law, and special needs planning practice. It is the firm’s mission to provide practical solutions to its clients’ needs through counseling, education, and the use of superior legal-technical knowledge. As it relates to special needs planning, the firm works collaboratively with individuals and families and their professional advisors to counsel, educate, and create a comprehensive plan for the family and their special needs loved one. This includes, among other planning considerations:

- establishing proper estate planning for the family, including the use of special needs trusts

- leveraging means tested public benefits

- selecting the proper team to provide lifetime management

- planning for appropriate housing and an ongoing system for advocacy

- providing financial security

- planning for caregiving needs

- coordinating the entire extended family’s planning

- protect the beneficiary from predators and preserving assets for other heirs

Should you have any questions about Elville and Associates and its services, please contact Steve Elville at steve@elvilleassociates.com, or by phone at 443-393-7696 x108. Community Relations Director Jeff Stauffer may also be reached at jeff@elvilleassociates.com, or at 443-393-7696 x117.

#elvilleeducation

#elvillewebinarseries

By: Stephen R. Elville – Managing Principal and Lead Attorney – Elville and Associates, P.C.

Every good estate plan (a will-based plan or trust-driven plan) should address contingencies. Some of these contingencies are basic and commonsensical, such as what happens if the individual beneficiary or charitable organization you leave property to does not survive you or no longer exists. One of the most important but least understood contingency provisions in estate planning is what estate planners refer to as the “ultimate beneficiary” or “remote contingent beneficiary” provision. This is the section or article of a will or trust that addresses what happens with the property being disposed of if nobody is living – no person for whom property was provided for and/or no organization that was designated to receive property is in existence (defunct). In other words, there has been a complete failure of beneficiaries. Now, some people still don’t get this, and that is understandable, so read on.

This remote contingent beneficiary or ultimate disposition provision is counterintuitive, hard to fathom, and so unlikely to be needed that we naturally turn away from the idea (and the pain) of even considering it. For this remote contingent beneficiary to become effective, it literally means that no one is living – no child, grandchild, or further descendant (or other beneficiary) is living and able to take the share of the property for distribution. Yes, it’s an incredibly sad and unthinkable part of estate planning, and oftentimes it is not even addressed as part of the planning. But it should be – every time. Now you may say, as many clients of mine have said, “Steve, I don’t even want to think about this”, and if so, I will say that I completely understand. But you should still address this fourth major component of most estate plans. Why? Because doing so can make you happy, potentially help others, and bring you peace of mind.

Most truly contemporary approaches to estate planning provide for some kind of standard back up clause directing where the property will go if there is a failure of beneficiaries. These types of remote contingent beneficiary designations typically direct that the property be distributed as if the person making the will or trust died single and without having executed a last will and testament – meaning that the property will be distributed according to the laws of intestacy (the state’s prescribed estate plan). Now that’s not the fun part, that’s just the default provision of most modern estate plans. But who would want that provision? I mean, really? Even though the possibility of this remote contingent beneficiary becoming effective someday is very remote, who would want to have a provision stating that they could possibly someday be deemed to have died without a will – after actually having established one?

So here’s the good news and the happy part. You don’t have to settle for such a non-descript, non-creative, and truly depressing remote contingent beneficiary. You can (and should) customize this part of your planning, and by doing so you will (in my estimation) be smarter and happier than at least seventy-five percent (75%) of those persons in the U.S. who actually engage in estate planning (about 45-50% of the population, depending on demographics). What does customizing this provision mean? Let me give you some brief examples: you leave your property to your friend(s); your church or synagogue; your favorite charity or charities; your college or university; or other disposition.

“But Steve,” you may say, “why do this when there is only the remotest possibility that none of my beneficiaries will be living and my remote contingent beneficiary will actually receive anything?” To this I say, yes, you are correct. But do not forget that in the case of a charity, religious or other institution, or your alma mater, for example, if you are inclined to include such a customized remote contingent beneficiary designation in your will or trust; and if you would be willing to let the organization or organizations in question know that you are making such a planned gift, however remote, they will be thrilled and will love you and your family for your commitment and philanthropic intent – and with your permission they will likely (1) honor you; (2) give you recognition; and (3) use your wonderful expression of giving as an example for other similar donors or potential donors, with the result that the beneficiary organization is very likely to benefit in the future from the collective results of your kindness and generosity. This is a very real, very needed, and very desired circumstance. Ask any director of planned giving at a hospital or other organization and they will tell you how thrilled and appreciative they would be if their organization was merely included in the wills or trusts of their broader community, alumni, congregation, members, etc.

So in closing, you don’t have to leave your will or trust open to a potential situation representing the antithesis of estate planning itself – intestate succession – unless there is a reason to do so. And even then, it may make sense to think through all known scenarios of intestate distribution and consider whether there are better and wiser options, such as a remote contingent beneficiary. Instead, consider customizing the ultimate or remote contingent beneficiary provision in your will or trust to beautify and solidify the last major element of your estate plan and not leave any aspect of the planning to chance. In doing so you will have successfully dealt with and handily defeated what is easily the saddest provision in the estate planning world and instead made yourself and the world at large happier and richer spiritually and mentally, with the potential for financially benefitting others in the bargain.

To speak to me about any matters related to estate and special needs planning, elder law, or estate and trust administration, feel free to reach out to me at steve@elvilleassociates.com, or at 443-393-7696 x108.

#elvilleeducation

#elvillewebinarseries

The preceding blog is meant for education only and not meant as a substitute for legal counseling.

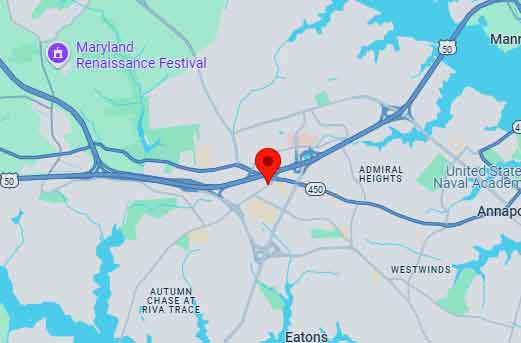

Stephen R. Elville to Present About Medicaid Asset Protection Trusts at MSBA Medicaid Planning Evening Series

By: Jeffrey D. Stauffer – Community Relations Director, Elville and Associates, P.C.

Stephen R. Elville, Managing Principal and Lead Attorney of Elville and Associates, a leading estate planning, elder law, and special needs planning firm in Maryland, will present during the fifth of six sessions of the Maryland State Bar Association’s Medicaid Planning Evening Series on Tuesday, May 4th. Mr. Elville will discuss “Medicaid Asset Protection Trusts – Drafting and Implementing: Estate Planning and Incapacity Planning when Medicaid Relevant.”

The MSBA’s Elder Law and Disability Rights Section livestream program began on Tuesday, April 6th and will conclude on Tuesday, May 11th. The six-part series covers all critical elements of Medicaid planning so attendees can best advise clients in this complicated practice area. Each two-hour session occurs weekly on Tuesday evenings. The full schedule of the livestream program includes many areas of Medicaid planning strategies, including:

Night 1: (Tuesday, April 6, 2021) Medicaid Planning Eligibility 101 – Technical, Financial, and Medical Issues. Preparing the Medicaid Application and Filing Online

Night 2: (Tuesday, April 13, 2021) Protecting Real Estate and Gifting Strategies for the Single Applicant in Medicaid Planning

Night 3: (Tuesday, April 20, 2021) SPIA Planning for Married Couples and Planning with Promissory Notes

Night 4: (Tuesday, April 27, 2021) Proving Disability (State Review Team). Disability and Special Needs Trusts in Medicaid Planning

Night 5: (Tuesday, May 4, 2021) Medicaid Asset Protection Trusts – Drafting and Implementing: Estate Planning and Incapacity Planning when Medicaid Relevant

Night 6:( Tuesday, May 11, 2021) Preparing and Applying for Yearly Redetermination of Medicaid Benefits. Building Your Practice

Should you have questions or need guidance related to Medicaid planning or any other elder law, estate planning, or special needs planning-related matter, contact Mr. Elville at steve@elvilleassociates.com, or at 443-393-7696 x108. The attorneys and professional staff of Elville and Associates are committed to and passionate about providing its

clients with a unique experience and exceeding their expectations as they navigate through the important decisions and complexities of estate planning, elder law and Medicaid planning, estate and trust administration, and special needs planning. The firm strives to assist its clients with compassion, through education and counseling, and in a collaborative manner – acting as a true partner as they work alongside their planning team advisors to provide the very best counsel and service possible.

#elvilleeducation

#elvillewebinarseries

Catch the Spring Spirit of Planning for Life Ahead

By: Stephen R. Elville, J.D., LL.M. – Managing Principal and Lead Attorney of Elville and Associates, P.C.

During this beautiful spring period of renewal, Elville and Associates continues to educate clients, their families, fiduciaries, and professional advisors. Only through client education and subsequent client care/maintenance and updating of estate plans can success in estate planning truly be assured over the long run during life, and at maturity. Whether you are young or old, of considerable wealth or of modest means, healthy and well or facing significant health challenges, availing yourself of continuing client legal education and taking advantage of a professional advisory team for the optimization of your estate, financial, and tax planning, can and will provide significant value to you and your family.

Now, more than ever, is the time to have your existing estate or elder care plan reviewed and updated, or to begin the process of establish your planning.

As the law firm in Maryland that talks the talk and walks the walk of client education, Elville and Associates is here to serve with leading edge legal-technical knowledge, client care, client education, collaboration, and compassion. Catch the spirit of planning for life and planning for legacies.

For more information or to set an appointment, please contact Community Relations Director Jeff Stauffer at jeff@elvilleassociates.com, or at 443-393-7696 x117. Mr. Elville may be reached directly at steve@elvilleassociates.com, or at x108.

#elvilleeducation

#elvillewebinarseries

People whose disabilities arose later in life will be able to open Maryland ABLE savings accounts if a bill just reintroduced in Congress, the ABLE Age Adjustment Act, becomes law.

In 2014, Congress passed the Achieving a Better Life Experience (ABLE) Act, which created a new form of tax-free savings account for people with disabilities and their families to set money aside for disability-related expenses. Simpler to set up than traditional trusts, Maryland ABLE accounts allow people with disabilities to save up to $100,000 in an account without jeopardizing their eligibility for Supplemental Security Income, Medicaid, and other government benefits. More than 82,000 ABLE accounts including those in Maryland have been established in all participating states since the Act’s passage.

However, Maryland ABLE accounts and others around the country are currently limited to people whose disabilities arise before the recipient turns age 26, effectively excluding millions of people with chronic conditions or traumatic life events that occurred in their middle years. Veterans are particularly affected by this limitation.

Raising the onset age above 26 has been a top priority for disability rights advocates for years. The ABLE Age Adjustment Act, which would allow Maryland ABLE accounts to be opened by people whose disabilities arose prior to age 46, was first introduced in Congress in 2016. Versions of the bill have been introduced each year since then. The measure was again reintroduced in both the House and Senate in February, 2021 (S. 331 and H.R. 1219). Supporters are hopeful that this will be the year that the bill finally becomes law.

If it passes and is enacted into law, the National Disability Institute estimates that an additional 6.1 million people would be eligible to open ABLE accounts in Maryland and around the country, according to a March 2 letter signed by dozens of disability advocacy groups under the umbrella of the Consortium for Citizens with Disabilities (CCD).

“Passing the ABLE Age Adjustment Act would nearly double the currently eligible population and improve the sustainability of ABLE programs nationwide,” the CCD wrote. “Most importantly, this bill would enable otherwise-eligible people with a variety of later-onset disabilities (many of whom spent years advocating for the original ABLE Act) to realize the benefits of the ABLE accounts to increase their financial security without jeopardizing their much-needed public benefits.”

“There are many people who become disabled after age 26 who deserve the opportunity to achieve greater financial independence and self-reliance,” Kandi Pickard, president and CEO of the National Down Syndrome Society, said in a news release. “In addition, the legislation will reduce costs and fees associated with administering state ABLE programs and make them more affordable for all beneficiaries.”

Click here to read the full Senate bill.

For information regarding the Maryland ABLE program, please visit marylandable.org. For a directory of state ABLE programs, click here.

To discuss how a Maryland ABLE account can be part of a comprehensive special needs plan for your family and your special needs loved one, contact the special needs planning attorneys at Elville and Associates for a free consultation to discuss your family’s situation. Our attorneys and professional staff are committed to and passionate about providing our clients with a unique experience and exceeding their expectations as they navigate through the important decisions and complexities of special needs planning. We strive to assist our clients with compassion, through education and counseling, and in a collaborative manner – acting as a true partner as we work alongside their planning team advisors to provide the very best counsel and service possible.

Legal Administrator Mary Guay Kramer may be reached at mary@elvilleassociates.com, or 443-741-3635, while Community Relations Director Jeff Stauffer can be reached at jeff@elvilleassociates.com, or 443-393-7696 x117.

#elvilleeducation

#elvillewebinarseries

Senior Principal and estate planning attorney Olivia Holcombe-Volke offers this discussion regarding the financial planning aspects of estate planning. Estate planning is so much more than a static set of documents. Learn why your estate plan needs to work in concert with the rest of your financial plan and why your estate planning attorney should be an integral part of your “planning team” – your financial planner/financial advisor, CPA, and other professionals”

– to ensure your plan works smoothly and as intended. Topics to be discussed include:

– Asset Alignment/Funding of the Estate Plan: Why is this so vital, and what does it mean?

– Beneficiary Designations: When, Why, How – Addressing the nuances depending on the type of estate plan, the type of asset, and the specific beneficiaries

– The Financial Planner/Financial Advisor: Why this is an integral piece in the success of an estate plan, from inception to ultimate administration

Open to clients, financial advisors, and the general public, 1.5 continuing education hours are offered to CFPs, CPAs, and other professionals who attend. This webinar is offered in partnership with the Howard County Library System, a longtime supporter of Elville and Associates’ educational programs. To learn more about the HCLS, its educational programs and calendar of events, please visit https://live-howardcounty.pantheonsit… or contact Ms. Rohini Gupta, Adult Curriculum Specialist, at rohini.gupta@hclibrary.org.

More Webinars from Elville and Associates

The education of clients and their families through counseling and superior legal-technical knowledge is the mission of Elville and Associates. We hold multiple educational events every month. Click to view our calendar of educational webinars and events or visit the Elville and Associates YouTube channel to view recordings of our past webinars.

This webinar is an in depth overview that thoroughly educates attendees about the essentials of estate and elder law planning. Presented by Elville and Associates’ Managing Principal and Lead Attorney Stephen R. Elville, in our Estate Planning and Elder Law Essentials webinar Steve thoroughly educates attendees about estate planning and incapacity planning issues. Some of the topics he addresses include:

– understanding the planning process, including the reasons for estate planning

– wills vs. trusts

– probate vs. non-probate and understanding non-probate devices

– the absolute importance of incorporating “flexibility” in your planning

– planning for incapacity

– understanding the importance of financial powers of attorney, advance medical directives and MOLST

– Medicaid- myths versus reality

– estate tax planning

– asset protection and protecting shares for children and grandchildren

– understanding why having outdated documents could provide challenges in the future, and how to achieve perfection for your legacy

More Webinars from Elville and Associates

The education of clients and their families through counseling and superior legal-technical knowledge is the mission of Elville and Associates. We hold multiple educational events every month. Click to view our calendar of educational webinars and events or visit the Elville and Associates YouTube channel to view recordings of our past webinars.