Passing assets to your grandchildren can be a great way to ensure their future is provided for, and a generation-skipping trust can help you accomplish this goal while reducing estate taxes and also providing for your children.

A generation-skipping trust allows you to “skip” over the generation directly below you and pass your assets to the succeeding generation. While this type of trust is most commonly used for family, you can designate anyone who is at least 37.5 younger than you as the beneficiary (except a spouse or ex-spouse).

One purpose of a generation-skipping trust is to minimize estate taxes. Estates worth more than $11.7 (in 2021) have to pay a federal estate tax. Twelve states also impose their own estate tax, which in some states applies to smaller estates. When someone passes on an estate to their child and the child then passes the estate to their children, the estate taxes would be assessed twice—each time the estate is passed down. The generation-skipping trust avoids one of these transfers and estate tax assessments.

While your children cannot touch the assets in the trust, they can receive any income generated by the trust. The trust can also be set up to allow them to have some say in the rights and interests of future beneficiaries. Once your children pass on, the beneficiaries will have access to the assets.

Note however, that a generation-skipping trust is subject to the generation-skipping transfer (GST) tax. This tax applies to transfers from grandparents to grandchildren, even in a trust. The GST tax has tracked the estate tax rate and exemption amounts, so the current GST exemption amount is $11.7 million (in 2021). If you transfer more than that, the tax rate is 40 percent.

The trust can be structured to take advantage of the GST tax exemption by transferring assets to the trust that fall under the exemption amount. If the assets increase in value, the proceeds can be allocated to the beneficiaries of the trust. And because the trust is irrevocable, your estate won’t have to pay the GST tax even if the value of the assets increases over the exemption amount.

Generation-skipping trusts are complicated documents. Consult with the attorneys at Elville and Associates to determine if one would be right for your family.

As we have written previously, there are a number of tax proposals being considered in Congress that could significantly affect gifting and estate plans. There are planning strategies to help protect your estate from future tax changes, so now is a good time to review your estate plan and see if you need to make adjustments.

Under Vermont senator Bernie Sanders’ For the 99.5 Percent Act, the estate tax exemption would be reduced from $11.7 million for individuals and $23.4 million for couples to $3.5 million for individuals and $7 million for couples. Any estate that is valued at under the exemption amount will not pay any federal estate taxes, while those exceeding the exemption threshold would be subject to a progressively increasing tax rate that starts at 45 percent. The Act would also slash the lifetime gift tax exemption from $11.7 million to $1 million, although individuals would still be able to give away $15,000 a year without the gift counting toward the lifetime limit. Take time to review your estate plan to ensure your plan is protected from future tax changes.

Another proposal in the Senate is the Sensible Tax and Equity Promotion (STEP) Act, which would eliminate the step-up in basis that beneficiaries receive when they inherit property. The proposal would require an estate to pay tax on all previously untaxed gains. This means that if an estate includes property that has increased in value, the estate would have to pay taxes on that increase. However, the Act would allow the first $1 million of appreciated assets to pass without taxation. In addition, families that inherit a farm or business would be able to pay the tax in installments over a 15-year period. Any taxes paid under the bill would be deductible from the estate tax. Be sure to review your plan with the attorneys at Elville and Associate to ensure it is prepared for these proposed changes.

President Biden has also introduced his tax proposals, which include an increase of the capital gains tax rate to 40 percent. This would apply only to income over $1 million. Biden’s proposal also contains a similar elimination of the step up in basis as the STEP Act. In addition, the proposal targets dynasty trusts. The income that has appreciated in a dynasty trust may be subject to capital gains if it hasn’t been subject to recognition in the past 90 years. There would also be no valuation discounts when calculating capital gains.

It isn’t clear which if any of these proposals will make it all the way through Congress and get signed into law, but with Democrats in control of both houses of Congress and the presidency, some changes are likely. It is difficult to plan given such uncertainty, but the following are some options to talk to the attorneys at Elville and Associates about before any of these proposals become law:

- Maximize the use of available exemptions by transferring assets into a trust before the end of the year. There are a number of different types of trusts that might be beneficial, including a spousal lifetime access trust (SLAT). Don’t forget about the generation-skipping transfer tax exemption, which allows you to transfer funds to a trust that benefits grandchildren. A review of your plan will help you understand how exemptions affect you.

- Consider including charities in your estate plan. A charitable remainder trust allows you to provide yourself and your spouse income during your lifetime and leave the remainder to a charity. Profits from the trust are not subject to capital gains taxes and the trust can help reduce your taxable estate. Consider a review of your plan to determine if a charitable remainder trust is a good strategy for you.

- Include a disclaimer in any trust you may have that would change provisions if there are changes to the tax code. To be effective, the disclaimer has to be carefully crafted.

- To avoid paying capital gains taxes on appreciated assets, consider borrowing money and putting it into a trust instead.

- Consider giving away a fractional interest in property before the end of the year and any valuation discounts may be eliminated.

- Make sure you have enough liquidity in your estate to pay any possible taxes that are due. You can do this using life insurance or through borrowing or increasing access to credit.

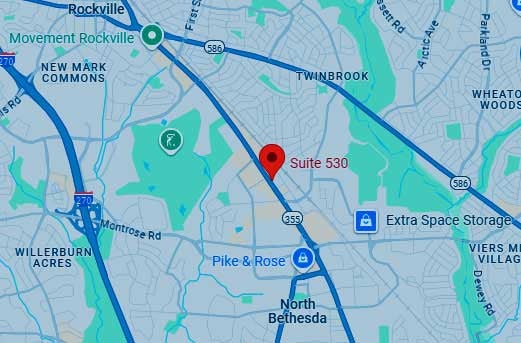

Before taking any steps, talk to the attorneys at Elville and Associates about what you can do now to protect your estate from future tax changes. To schedule a consultation to review your estate plan, please reach out to the firm’s Legal Administrator, Mary Guay Kramer, at mary@elvilleassociates.com, or fill out our contact form on our website by clicking here.

#elvilleeducation

#elvillewebinarseries

Webinar attendees come to understand what is involved in the planning process for a special needs family and the importance of preserving your loved one’s financial security and quality of life. Presented by Elville and Associates’ Managing Principal and Lead Attorney Stephen R. Elville, this webinar is a broad reaching discussion about planning for their loved one with special needs.

The key issues of understanding the role of public benefits, making decisions about the future, Maryland ABLE, creating flexibility in your planning, and using estate planning and trusts to protect assets are discussed along with the types of special needs trusts and their specific purposes (along with who the decision makers and beneficiaries can be in these trusts). Also, touched upon is the “planning team concept” – how your planning team (attorney, financial advisor, CPA, and others) – can work together to help provide your family peace of mind during the special needs planning process.

More Webinars from Elville and Associates

The education of clients and their families through counseling and superior legal-technical knowledge is the mission of Elville and Associates. We hold multiple educational events every month. Click to view our calendar of educational webinars and events or visit the Elville and Associates YouTube channel to view recordings of our past webinars.

August Is ABLE to Save Month!

August is national ABLE to Save Month! We are celebrating the Maryland ABLE program during ABLE to Save Month, which makes it possible for Marylanders with disabilities to have greater independence and financial stability. A Maryland ABLE account can change the way people with disabilities and their families participate in the community, build financial wellness, and plan for the future by empowering them to save and invest for the added expenses that come with having a disability.

During ABLE to Save Month, learn more about how a Maryland ABLE account can help people with disabilities and their families pay for everyday needs, save and invest with a tax-advantaged account, and prepare for the future while keeping federal and state means-tested benefits such as SSI and Medicaid. During ABLE to Save Month and beyond, should you have any questions about Maryland ABLE accounts, please reach out to Maryland ABLE’s Communications Manager, Kelly Nelson, at knelson@marylandable.org.

The attorneys and staff at Elville and Associates have been fortunate to maintain a very strong relationship with Maryland ABLE over the years through its focus on special needs planning here at the firm. A Maryland ABLE account can be a powerful tool used as part of family’s special needs planning.

For more detailed information pertaining to your circumstances, it is very important to partner with a law firm that specializes in the area of special needs planning and understands the nuances associated with it. Founded in June 2010 by Stephen Elville, J.D., LL.M., Elville and Associates is an estate planning, elder law, and special needs planning practice. It is the firm’s mission to provide practical solutions to its clients’ needs through counseling, education, and the use of superior legal-technical knowledge. As it relates to special needs planning, the firm works collaboratively with individuals and families and their professional advisors to counsel, educate, and create a comprehensive plan for the family and their special needs loved one. This includes, among other planning considerations:

- establishing proper estate planning for the family, including the use of special needs trusts

- leveraging means tested public benefits

- selecting the proper team to provide lifetime management

- planning for appropriate housing and an ongoing system for advocacy

- providing financial security

- planning for caregiving needs

- coordinating the entire extended family’s planning

- protect the beneficiary from predators and preserving assets for other heirs

Should you have any questions about Elville and Associates and its services, please contact Steve Elville at steve@elvilleassociates.com, or by phone at 443-393-7696 x108. Community Relations Director Jeff Stauffer may also be reached at jeff@elvilleassociates.com, or at 443-393-7696 x117.

#elvilleeducation

#MarylandABLE

Understanding Alzheimer’s and Dementia

Understanding Alzheimer’s and Dementia: A discussion of the risk factors, stages of the disease, and current research will be provided by Ellen Perticone, Owner of Senior Placement Navigators, in collaboration with the Alzheimer’s Association. Topics to be discussed include:

- Understand the relationship between Alzheimer’s and dementia

- Find out how Alzheimer’s disease affects the brain

- Explore the risk factors and stages of the disease

- Learn about current research and FDA-approved treatments that address some symptoms

- Identify Association resources

More Webinars from Elville and Associates

The education of clients and their families through counseling and superior legal-technical knowledge is the mission of Elville and Associates. We hold multiple educational events every month. Click to view our calendar of educational webinars and events or visit the Elville and Associates YouTube channel to view recordings of our past webinars.

Pets are an integral part of American life. For many, the great joy, love, affection, and satisfaction derived from the experience of pet ownership is one of life’s great experiences. Millions of pet owners across the country make huge sacrifices for the care and maintenance of their pets and consider them part of their family. Pet ownership also provides many ancillary benefits to people, including improved health. Stephen R. Elville, Managing Principal and Lead Attorney of Elville and Associates, P.C., leads a discussion about how individuals may develop pet-related provisions in their estate plan for the care, maintenance, security, and long-term well-being of the pet(s), thereby creating an empowering situation for the owner, the trustee of a trust for the benefit of a pet, the caretaker or custodian of the pet, and for the pet itself. The following topics are discussed:

(1) Why clients should consider the use of pet care provisions in Wills and Trusts;

(2) Why pet care provisions in power of attorney documents are equally important;

(3) Understanding Maryland law relating to pet trusts;

(4) Utilizing a stand-alone pet trust versus other alternatives;

(5) Understanding practical pet care provisions outside of formal pet trusts;

(6) Utilizing Letters of Wishes for pet care;

(7) The structure of pet trusts – how does it all work; and

(8) The funding and alignment of assets in pet trusts and pet care-related provisions.

More Webinars from Elville and Associates

The education of clients and their families through counseling and superior legal-technical knowledge is the mission of Elville and Associates. We hold multiple educational events every month. Click to view our calendar of educational webinars and events or visit the Elville and Associates YouTube channel to view recordings of our past webinars.

Most people want to pass their assets to their children or grandchildren, but naming a minor as your estate plan beneficiary can have unintended consequences. It is important to establish a plan that doesn’t involve leaving assets directly to a minor.

There are two main problems with naming a minor as your life insurance policy, retirement account, or estate plan beneficiary. The first is a large sum of money cannot be left directly to a minor. Instead, a court will likely have to appoint a conservator to hold and manage the money. The court proceedings will cost your estate, and the conservator may not be someone you want to oversee your children’s money. Depending on the state, the conservator may have to file annual accountings with the court, generating more costs and fees.

The other problem with naming a minor as your estate plan beneficiary is that the minor will be entitled to the funds from the conservator when he or she reaches age 18 or 21, depending on state law. There are no limitations on what the money can be used for, so while you may have wanted the money to go toward college or a down payment on a house, the child may have other ideas.

The way to get around these problems is to create a trust and name the minor as beneficiary of the trust. A trust ensures that the funds are protected by the trustee until a time when it makes sense to distribute them. Trusts are also flexible in terms of how they are drafted. The trust can state any number of specifics on who receives property and when, including allowing you to distribute the funds at a specific age or based on a specific event, such as graduating from college. You can also spread out distributions over time to children and grandchildren.

If you do create a trust, remember to name the trust as beneficiary of any life insurance or retirement plans. If you forget to take that step, the money will be distributed directly to the minor, negating the work of creating the trust.

For more information about estate plan beneficiary choices, please click here.

To create a trust, be sure to consult with your attorney. It is extremely important to talk with your attorney before creating any estate planning or legal documents, especially a document such as a trust. Consult with the estate planning attorneys at Elville and Associates to make sure you have all the estate planning and legal documents you need. The firm offers free consultations for estate planning clients to understand your situation and goals and create a path forward for your family and you, offering peace of mind along the way. To set your initial consultation, contact Legal Administrator Mary Guay Kramer at mary@elvilleassociates.com, or by phone at 443-741-3635. Or, reach out to Community Relations Director Jeff Stauffer at jeff@elvilleassociates.com, or by phone at 443-393-7696 x117.

#elvilleeducation

#elvillewebinarseries

Webinar — The National Multiple Sclerosis Society: A Movement by and for People Living with MS

Elville and Associates partners with the staff at the National Multiple Sclerosis Society (NMSS) to learn about what MS is, the services and resources they have for people affected by MS, and how to get involved. You also have the opportunity to hear from someone living with MS. Feel free to send in questions to Jeff Stauffer, Community Relations Director with Elville and Associates at jeff@elvilleassociates.com, prior to the event.

Attendees:

– Learn what MS is

– Understand who the National Multiple Sclerosis Society is, resources we have available and how to get involved

– Hear from someone living with MS

More Webinars from Elville and Associates

The education of clients and their families through counseling and superior legal-technical knowledge is the mission of Elville and Associates. We hold multiple educational events every month. Click to view our calendar of educational webinars and events or visit the Elville and Associates YouTube channel to view recordings of our past webinars.

More Webinars from Elville and Associates

The education of clients and their families through counseling and superior legal-technical knowledge is the mission of Elville and Associates. We hold multiple educational events every month. Click to view our calendar of educational webinars and events or visit the Elville and Associates YouTube channel to view recordings of our past webinars.

Now is the time to think about steps you can take to keep your estate from being taxed with an irrevocable life insurance trust that allows you to pass money on to your heirs and avoid state and federal estate taxes.

Senate Democrats have proposed lowering the current estate tax exemption from $11.7 million to $3.5 million for individuals, and from $23.4 million to $3.5 million for couples. While it is unclear if this proposed estate tax legislation will pass, it is likely that changes to the estate tax are coming. Even if Congress takes no action, the current tax rate will sunset in 2026 and essentially be cut in half, to about $6 million per individual.

One way to make up for any estate tax your estate may have to pay is to set up an irrevocable life insurance trust (ILIT) and funding it with an insurance policy that includes a death benefit that will pay your heirs some or all of the amount your estate will be taxed. If you purchase such a life insurance policy directly, it may be taxed as part of your estate. But if an ILIT owns the policy, it may pass outside your estate.

Irrevocable Life Insurance Trust Requirements

While an ILIT can be highly beneficial, it is also complicated to set up and maintain properly. The following are some of the requirements:

- Trustee. If you are setting up the ILIT you cannot also serve as a trustee. If you are the trustee, you have control of the trust, which could lead to the trust being included in your estate. You will need to name another trusted person or financial institution to act as trustee.

- Policy ownership. The irrevocable life insurance trust must own the life insurance policy. If you transfer an existing policy to the trust and die within three years, the policy will still be considered a part of your estate. To avoid this risk, the trust can purchase a policy directly rather than receive an existing policy.

- Premiums. You need to transfer funds to the irrevocable life insurance trust to pay the policy premiums, which creates an issue with gift taxes. A transfer to a trust is usually not subject to the $15,000 yearly gift tax exclusion. In order for a gift to qualify for the exclusion, the recipient must have a “present interest” in the money. Because a promise to give someone money later does not count as a present interest, most gifts to irrevocable life insurance trusts aren’t excluded from the gift tax. To avoid this, you can use something called a “Crummey” power which gives beneficiaries the right to withdraw the funds transferred to the trust for up to 30 days. As part of the process, the trustee needs to send them a letter, known as a Crummey letter, letting them know about the trust funding and their right to withdraw the funds. After the 30 days have passed, the trustee can use the funds to pay the annual insurance premium. You run the risk of the beneficiaries withdrawing the funds, but if they know that by allowing the money to stay in the irrevocable life insurance trust they will receive more money later, it shouldn’t be a problem.

- Beneficiaries. The beneficiary of the life insurance policy is usually the irrevocable life insurance trust. Once the funds are deposited in the trust, the trustee can distribute the assets to the beneficiaries in the way specified by the trust. For example, if your beneficiaries are minors, you can wait to have the trustee distribute the assets. Keeping the assets in the irrevocable life insurance trust will also protect them from your beneficiaries’ creditors.

Downside of Irrevocable Life Insurance Trust

The downside of an irrevocable life insurance trust is that you do not have the ability to change it once it is set up — although the policy would effectively be canceled if you stopped paying the premiums.

If you are considering this type of trust, discuss it with your attorney.

It is extremely important to talk with your attorney before creating any estate planning documents, especially such a tool as an irrevocable life insurance trust. Consult with the estate planning attorneys at Elville and Associates to make sure you have all the estate planning documents you need. The firm offers free consultations for estate planning clients to understand your situation and goals and create a path forward for your family and you, offering peace of mind along the way. To set your initial consultation, contact Legal Administrator Mary Guay Kramer at mary@elvilleassociates.com, or by phone at 443-741-3635.

#elvilleeducation